Why Qubika

Discover what makes us different

Financial services

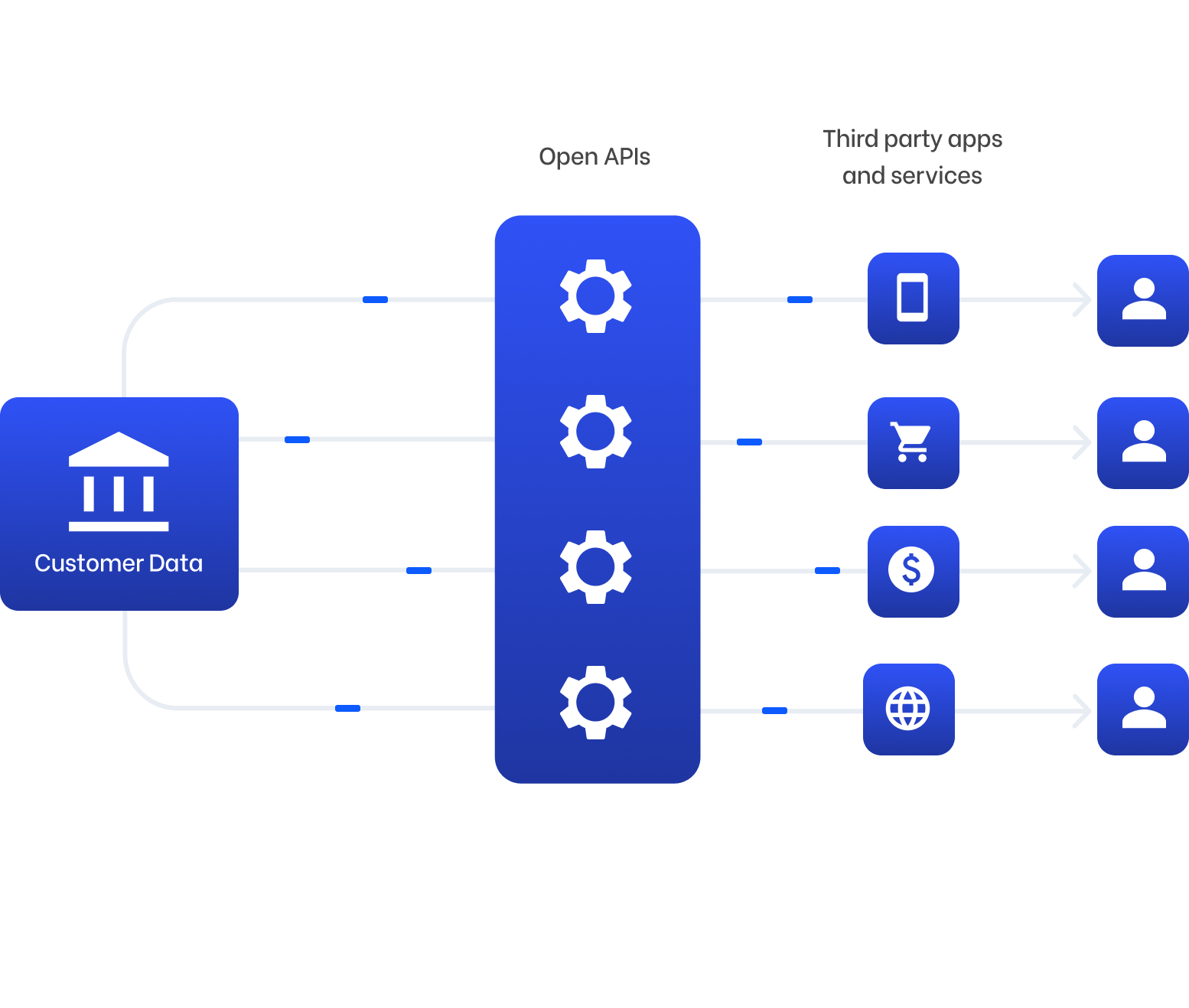

Expertise in core banking, BaaS integrations, payments, and GenAI-enhanced financial solutions.

Healthcare

People-centric healthcare design and solutions, from virtual care, integrations, to smart devices.

Insurance

Modern solutions including self-service, on-demand, and algorithm-driven personalization.

We’re purposefully shaping the digital future across a range of industries.

Discover some of our specific industry services.

Discover more

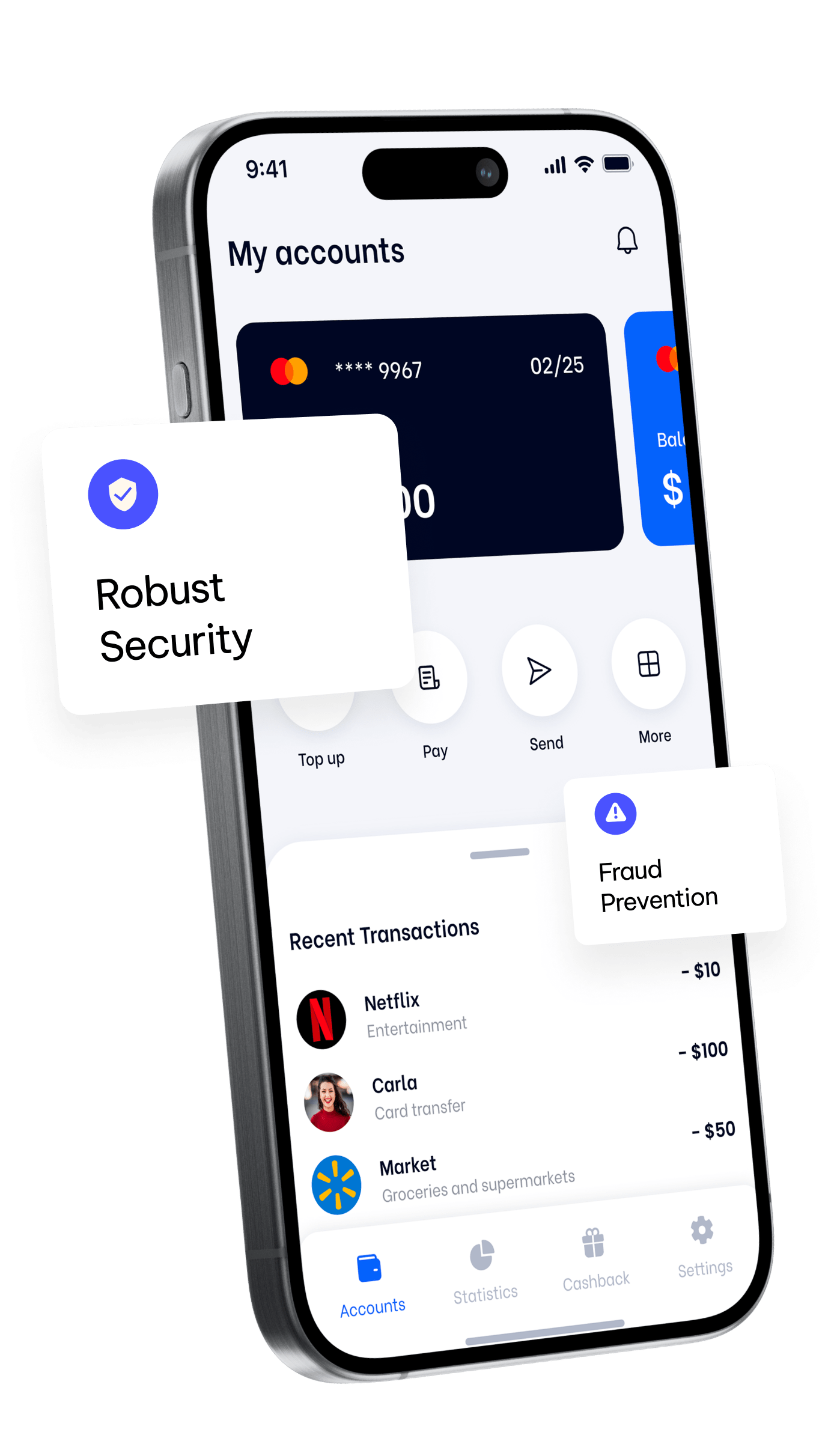

Our expertise ranges from building core banking and payment systems to implementing robust security and fraud prevention measures, to ensuring compliance with regulatory standards.

15+

15+ years of experience in financial services

100+

100 million+ customers use financial systems built by Qubika every day

75%

of Qubika’s largest clients are in financial services

Our client with 3 million+ customers & 1 million+ issued credit cards released a machine learning driven credit assessment to quickly & accurately assess the credit worthiness of customers.

We developed proprietary & used existing machine learning models to dig into metrics including credit bureau reports & transaction data.

This has resulted in

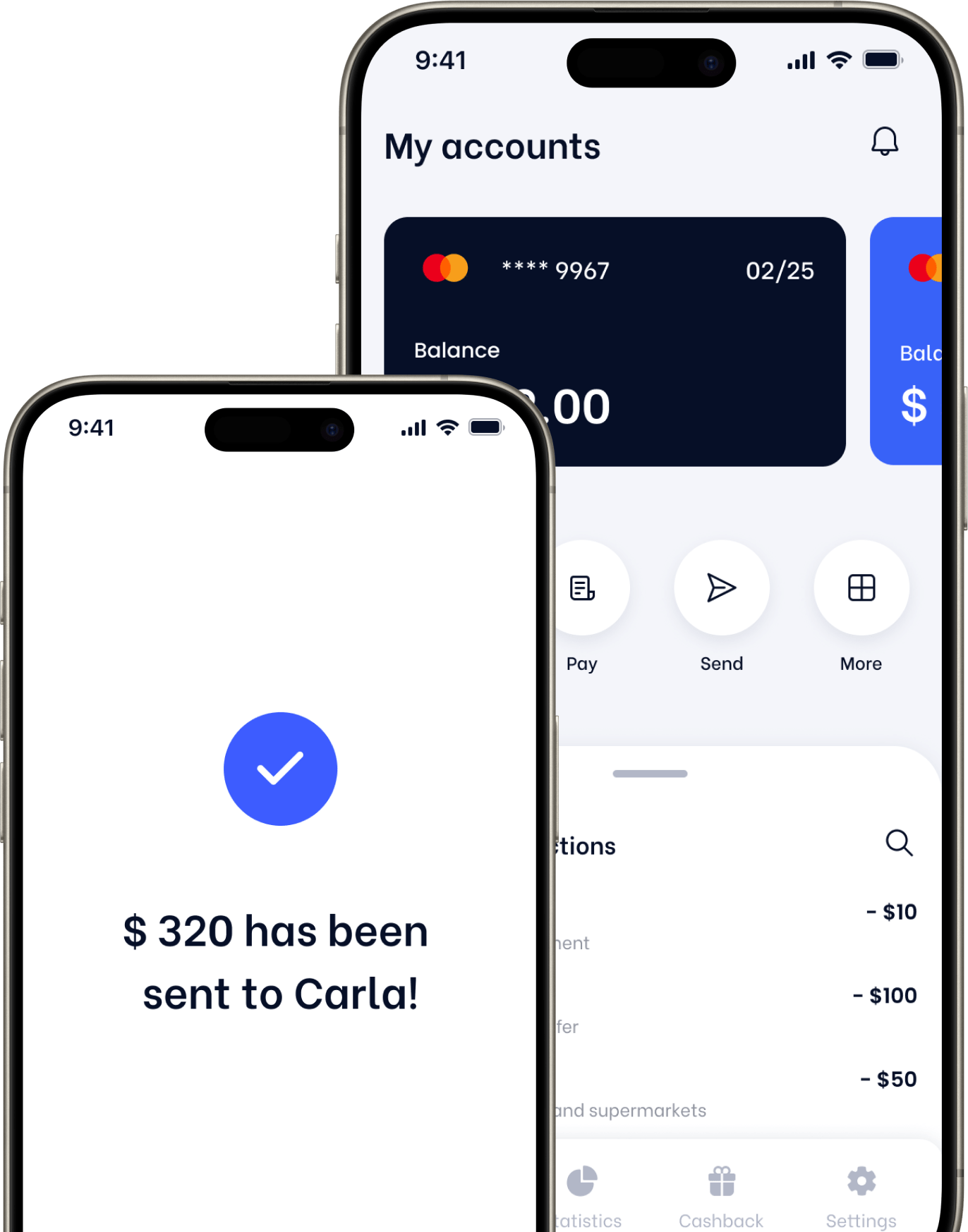

Our client’s vision was to provide an all-in-one financial experience, offering debit cards, bank accounts, credit services, and a budgeting app in one easy-to-use mobile platform.

Our team worked to build the app from scratch using React Native.We integrated complex and diverse banking features into the app, while ensuring ease of use, high performance, and robust security.

Outcomes achieved

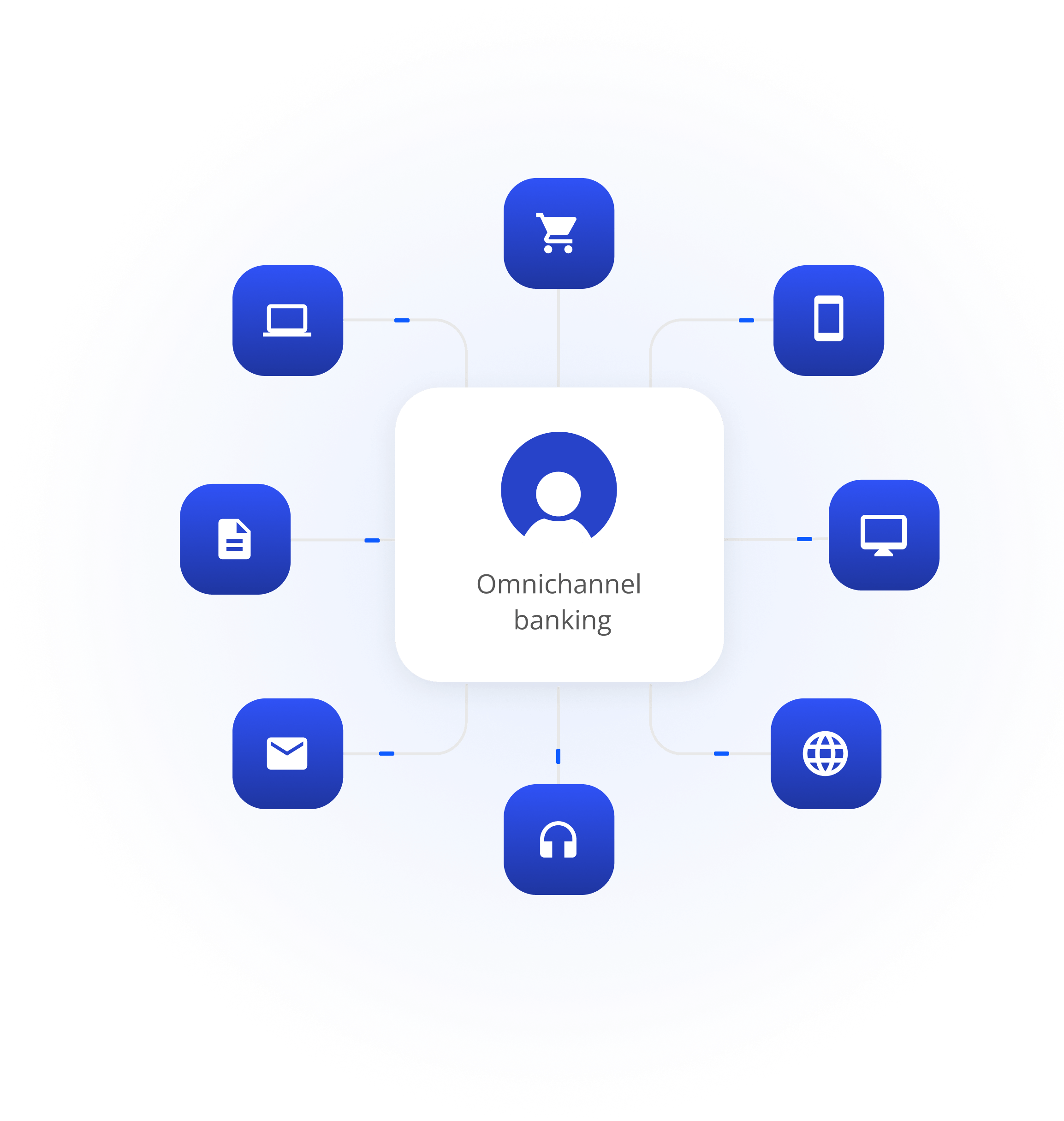

Our client that boasts 28 million+ customers, and is one of America's most renowned financial institutions, is redefining modern banking.

They’re providing all the modern financial services people expect today, such as being able to transfer money, pay bills and more, online or on your phone— without a physical bank.

To achieve this, Qubika brought together a set of digital banking technology services, including

“For us they are not just a software provider, they are a trustworthy partner with high level technical knowledge that provides value through innovative technical solutions”

Javier Martinez

CTO, Bancard

“They are behind the most important channel for BCP – the one that’s responsible for 90% of transactions.

This gives a sense of the importance of the relationship and our trust in them.

The expertise and skills of their team has been instrumental in helping us make the shift to become a truly digital bank.”

Christian Cervero

Head of alternative channels and digital solutions, BCP

“They’re the highest-quality development firm I’ve ever worked with. I can firmly say that they have provided excellent service.”

Abe Matamoros

Co-Founder, Elliegrid

“They have the culture, the people, the personalities and the interest in aligning towards a common goal with our larger business. They became an extension of our business and their team never felt like a vendor”

Michael Fay

VP Media Distribution, Disney Streaming Services

Success Stories

Avant, a Chicago-based frontrunner in the financial technology sector, has always recognized the potential of harnessing data-driven intelligence - they currently connect 3 million customers to $9 billion in loans and 1 million credit cards. Qubika is partnering with Avant to drive their data and machine learning initiatives.

Our work includes implementing new data pipelines, and using AI to drive innovation in key business areas, such as rapidly assessing a person’s credit worthiness.

Success Stories

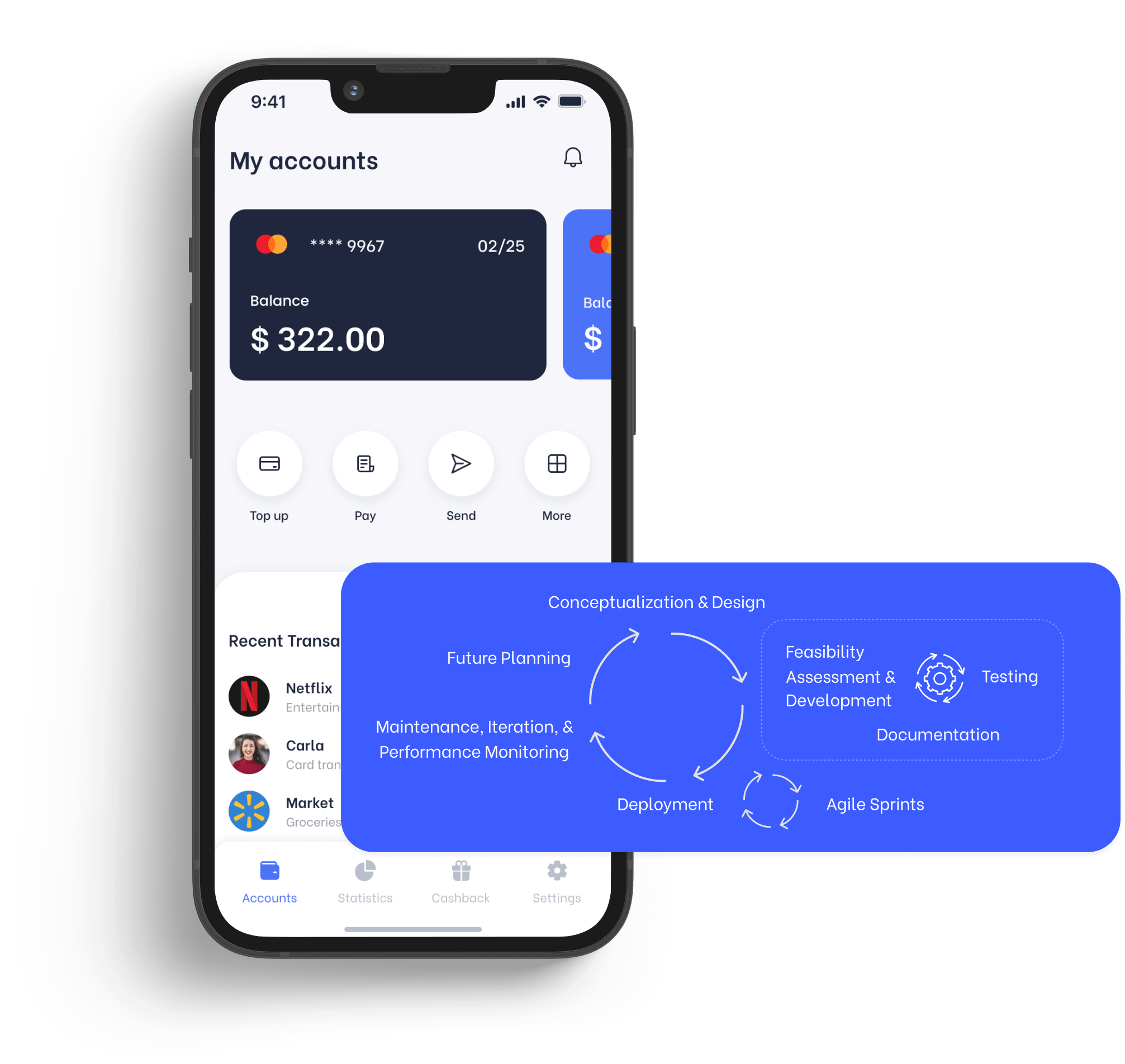

ONE's vision is to provide an all-in-one financial experience, offering debit cards, bank accounts, credit services, and a budgeting app in one easy-to-use platform. With over two million users, they are also being integrated into Walmart’s physical and digital channels.

Our partnership spans across key business and technology areas, from building a powerful mobile experience to transforming the development lifecycle from ideation to delivery.

Success Stories

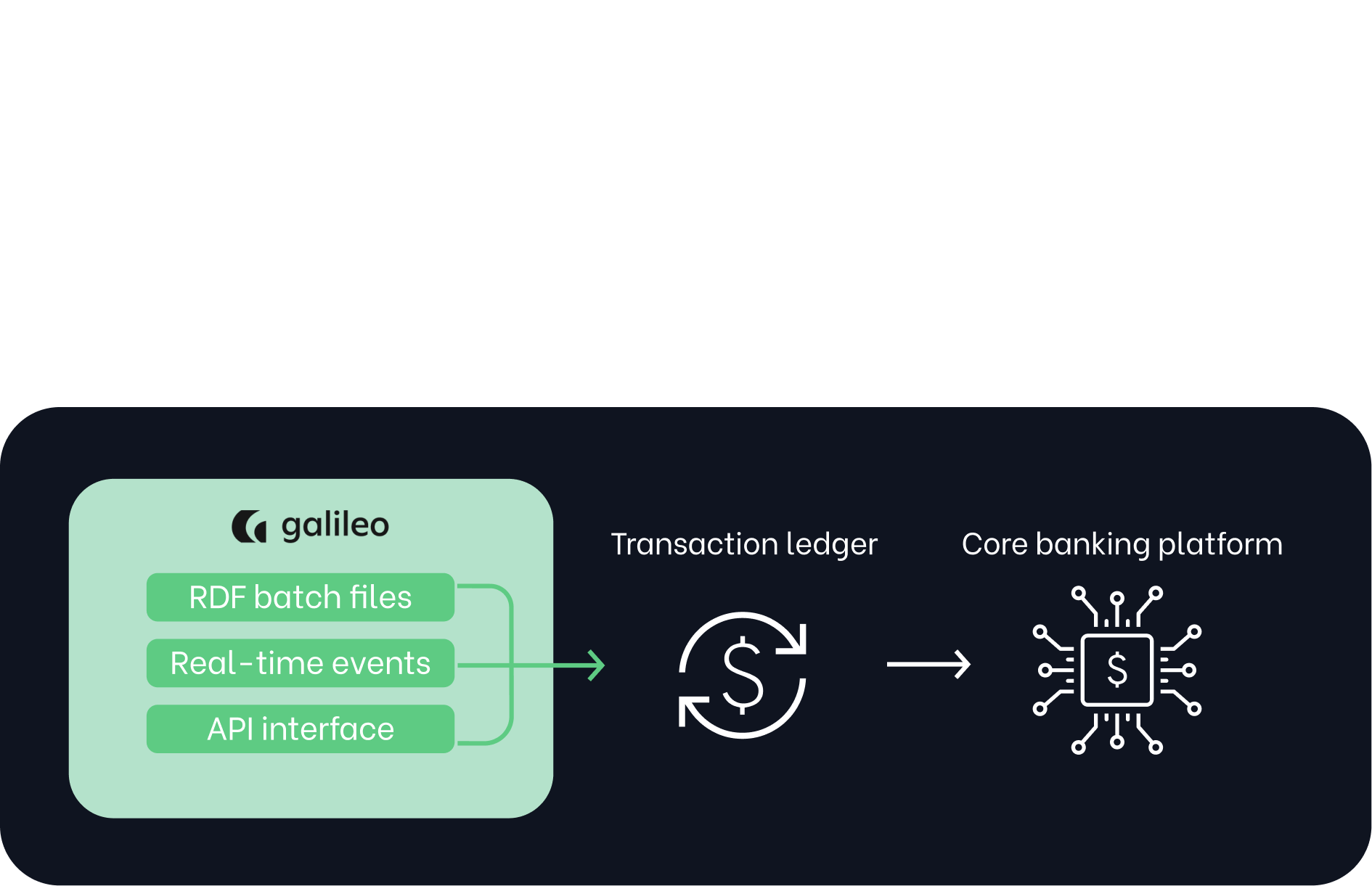

With clients in over 100 countries, and over 21,000 employees, Experian is at the forefront of global information and financial services.

Experian is relying on Qubika’s data and financial expertise to build new financial services products at scale. This work involves massive scale integrations including banking-as-a-service integrations. We play a crucial role in ensuring the accuracy, security, and efficiency of transactions.

Get in touch with our experts to review your idea or product, and discuss options for the best approach

Get in touch