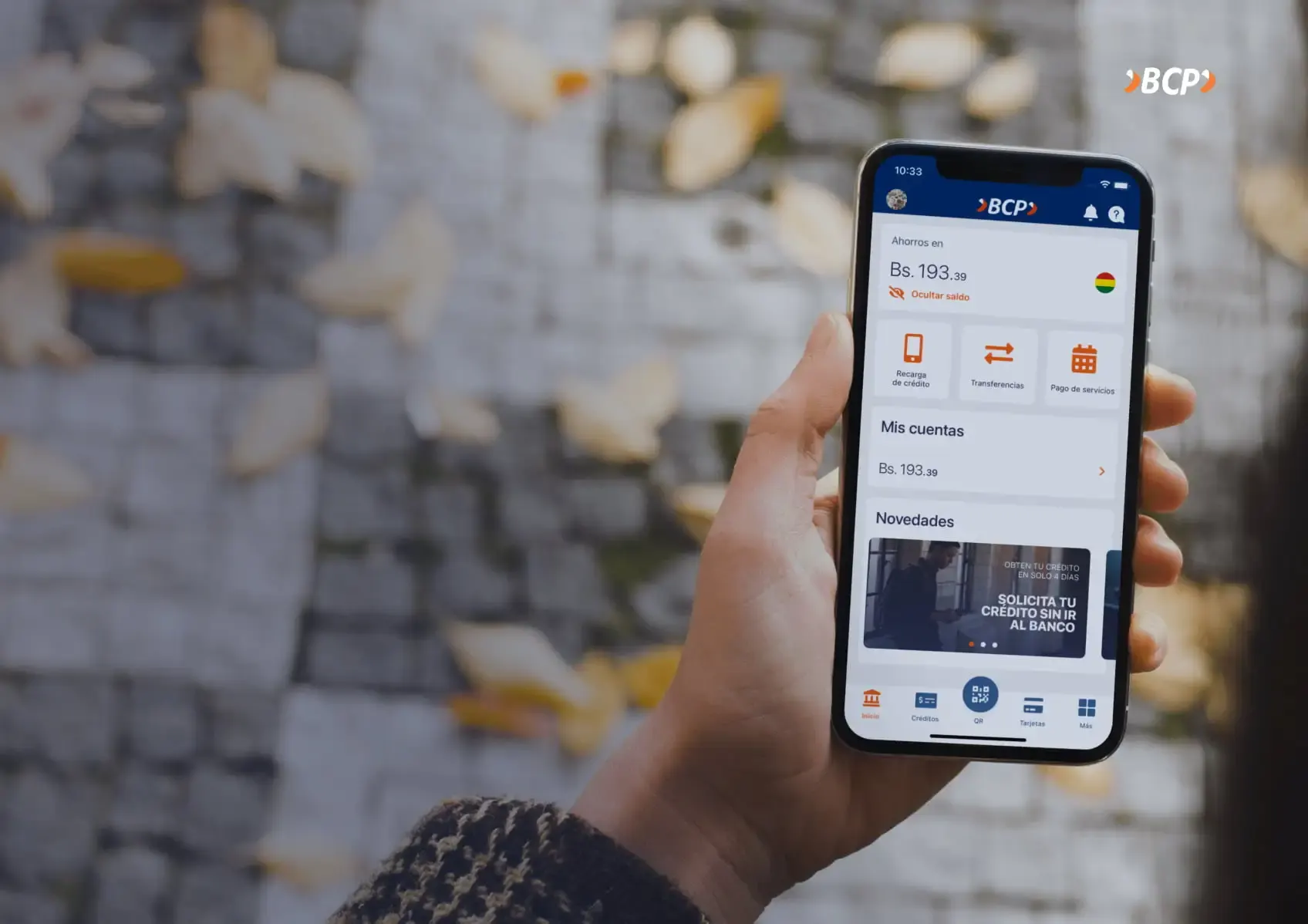

The mobile bank BCP Bolivia has become one of the best banking apps in Bolivia. More than one million transactions per month are conducted via their mobile bank channel with transaction volume reaching US $120 million, reflecting 83% growth compared to 2020. These numbers reflect the rapid adoption of digital technologies within the country. Bolivia’s population for instance has enthusiastically embraced financial applications, with finance apps featuring among the most popular apps on peoples’ cell phones.

Here at Qubika, we’ve been partners with BCP Bolivia for several years. It’s one of the largest banks in Latin America, with a particularly strong presence in Peru and Bolivia.

We sat down with Christian Cervero, BCP Bolivia’s head of alternative channels and digital solutions, to discover more about how they have achieved this success.

Thank you Christian for taking the time to chat. What is your strategy for launching new financial products and services?

“At a high level we have the objective of launching “something impressive” four times a year – clearly this can vary, but it’s essential we focus on constantly providing new and innovative services for our customers.

We’ve already achieved a lot – a rapidly growing number of transactions via our mobile channels, and in the Google Play store, we have one of the highest rankings compared to other financial services providers. This remains a powerful measurement of how our customers view the application. We’re using new tools to better personalize and improve our mobile application – which has quickly become the key channel for customers to engage with BCP Bolivia’s services.”

What steps did you take to ensure the mobile application resonated with customers?

“One of the key things was to generate a feedback loop between the customer experience and the development processes – and for that we’ve been using Agile development and DevOps extensively.

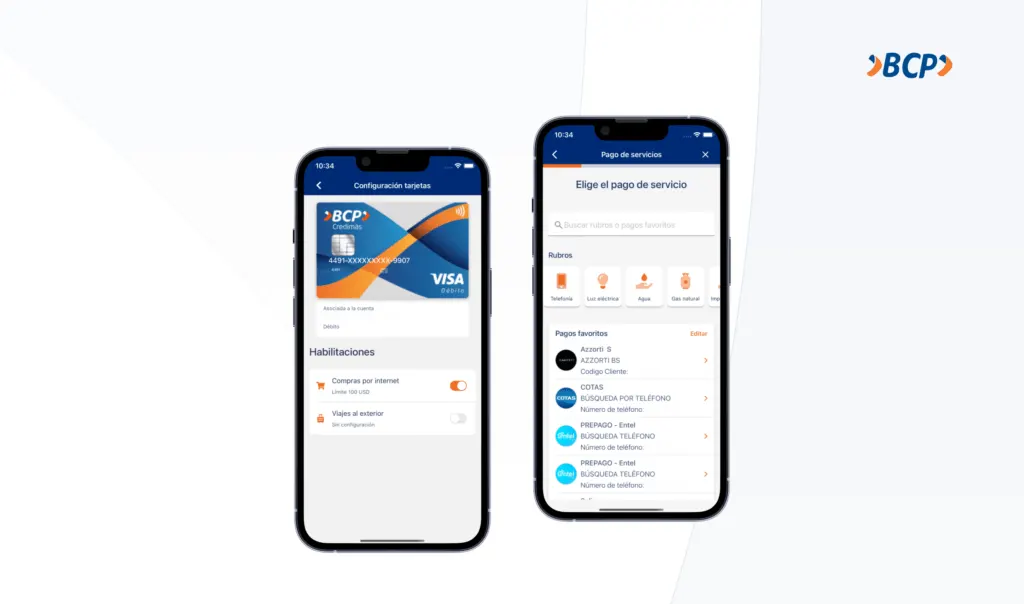

We’re recognized the importance of the design of the app – by that, I mean everything from the colors to the text, to the navigation, to not only create a great user experience, but also to strengthen the BCP Bolivia brand.”

“It’s also about understanding banking processes within the context of the customer experience – how to move quickly and nimbly to deliver services that customers want. And to do this means moving at speed, and also reviewing the metrics by which we measure success. It’s not just about becoming a more efficient bank, but rather providing a powerful experience to customers.”

Are there specific tools and methodologies that you’re using?

“We’re using Scrum and also methods such as Design Thinking and in-depth customer interviews. We’ve also done studies where large numbers of people test the application – similar to a crowd sourced test, so we can see how people use it in their day-to-day lives. We can then measure their level of satisfaction. We’ve also used remote control testing – where we can test the application from a web browser – this enables us to test the app in real-life situations in various locations.”

What is the bank’s strategy for 2022 and beyond?

“For 2022 we’re expecting to almost double the number of transactions compared to 2021. Looking forward, we’re also examining “transfers 2.0”. For customers, being able to transfer money is one of the most common and important activities. Recently, we’ve seen how it’s become common to do this, just with someone’s cell phone number. But we believe there are other ways, and that we can continue to improve and make transfers easier for people. We’re also focusing on NFC and making it easier for people to make payments.”

How is the relationship with Qubika?

“Qubika is behind the most important channel for BCP Bolivia – the one that’s responsible for 90% of transactions. This gives a sense of the importance of the relationship and our trust in you. The expertise and skills of Qubika has been instrumental in helping us make the shift to become a truly digital bank.”

Conclusion: Building a compelling application means creating a closer relationship with customers

Creating a mobile application that people intuitively use for their everyday financial needs is what every bank and financial institution has been working towards for the past couple of years. But as technologies change quickly, and customer behaviors and desires even faster, so this represents an ongoing challenge. We’re proud of our partnership with BCP Bolivia and what we’ve been able to accomplish so far, while we now strive to launch even more innovative products and services.