About us

With 20 years of experience, our expertise spans the AI lifecycle - from data engineering and AI agent development to cloud integrations and human-centric product design.

Learn more

Qubika at Databricks Data + AI Summit

Join us June 9-12 to see our leading Databricks capabilities

Our Studios

Our Studio delivery model enables us to address challenges head-on by bringing technology and domain experts together. This ensures we deliver immediate business value with our customized solutions.

Learn moreQubika Studios

Product Design

UX research, service design, design thinking, and UI design.

Artificial Intelligence

Agentic AI, GenAI, machine learning, NLP, computer vision.

Data

Data manipulation, engineering, visualization, and prediction.

App Solutions

Native or hybrid, SDK development, integrations, app store positioning.

Cloud, SRE, & DevOps

Cloud migration, CI/CD pipeline development, SRE, infrastructure-as-code.

Cybersecurity

Secure SDLC, AI-powered cybersecurity, vCISO, penetration testing, AI security assessments.

Platform Engineering

Robust infrastructures, scalable APIs, efficient deployment.

Quality Assurance

AI-augmented QA, test automation, CI/CD, load and performance testing, data testing.

Embedded Engineering

Development for semiconductors, embedded systems, IoT, & microcontrollers.

Product Management

Product consulting, process management, monetization.

Blockchain

Smart contracts, decentralized apps, blockchain integration.

Industries

Qubika partners with leading organizations across industries, delivering technology solutions that drive transformation and measurable results. Our expertise empowers clients to achieve business goals through tailored digital strategies.

Our Industries

Banking

Modernize banking systems for a secure, compliant, AI-ready enterprise ecosystem.

Financial Services

Secure, data and AI-driven financial services - from paytech and financial infrastructure to risk, compliance and analytics.

Health & Wellbeing

People-centric healthcare solutions, from virtual care to integrations and smart devices.

Insurance

AI-powered insurance solutions - from accelerating policy lifecycle management to accelerating claims processing.

Media & Entertainment

AI-native solutions to deliver personalized, real-time, and immersive experiences at scale.

Hi-Tech & Semiconductors

Semiconductor design, firmware, and IoT development, AI-powered embedded systems.

Industry Insights

Impact Studies

Explore in-depth case studies showcasing how Qubika empowers organizations to lead, innovate, and transform their industries. Your journey begins here.

Learn moreAvant

Explore how Qubika and Avant are building a new generation of data and AI-driven financial services for their 3 million+ customers.

OnePay

Qubika is a transformational partner to Walmart's fintech, ONE, creating an all-in-one financial experience for its 1 million+ customers.

Shopify

Qubika worked with one of the largest multinational e-commerce companies, Shopify, to transform the digital merchant and retail experience.

MyRow

Explore how Qubika applied its AccelerateAI framework with MyRow to harness AI-driven development and significantly improve speed-to-value.

Tabula Rasa

Tabula Rasa leveraged agile product management to revolutionize drug traceability, streamline processes, and achieve a rapid market launch.

YouScience

The Qubika Data Studio used machine learning to create hyper-personalized career paths for students on the YouScience edtech platform.

Computer Vision

Qubika is a leading provider of computer vision solutions. These case studies show how we're using AI to build innovative products that are transforming lives.

Wearables

Qubika is at the forefront of the wearable revolution. See a selection of our case studies.

Insights

Dive into our expert insights on the latest in technology and business developments.

Learn moreKey Categories

More Insights

Highlighted Posts

Latest Posts

Partners

About us

With 20 years of experience, our expertise spans the AI lifecycle - from data engineering and AI agent development to cloud integrations and human-centric product design.

Learn more

Careers

Are you interested in shaping the AI-future? Then discover how you can join one of the fastest growing companies in the industry.

Learn more

Locations

Qubika's locations are centers of high-quality innovation. Explore our global network and get in touch with our experts.

Learn moreDatabricks Solutions

We've empowered numerous industry leaders to harness the full potential of Databricks' Intelligence platform, driving transformative results and measurable business impact.

Highlights of our partnership

Select Tier Partner

Qubika is a Select Tier Databricks partner, delivering scalable, secure data and AI solutions on Databricks.

200+ certified Databricks engineers

Qubika has 200+ certified engineers on the Databricks Intelligence Platform

20+ years of data experience

Qubika has been providing end-to-end data services for over 20 years.

Databricks Insights

Qubika is a next generation service provider that partners to reimagine financial services with technology. From core banking and BaaS to financial AI agents and payments, we engineer secure, scalable, data- and AI-driven solutions.

20+

20+ years of experience in financial services

100+

100 million+ customers use financial systems built by Qubika every day

75%

of Qubika’s largest clients are in financial services

Avant with 3 million+ customers & 1 million+ issued credit cards released a machine learning driven credit assessment to quickly & accurately assess the credit worthiness of custom

We developed proprietary & used existing machine learning models to dig into metrics including credit bureau reports & transaction data

Our work in action

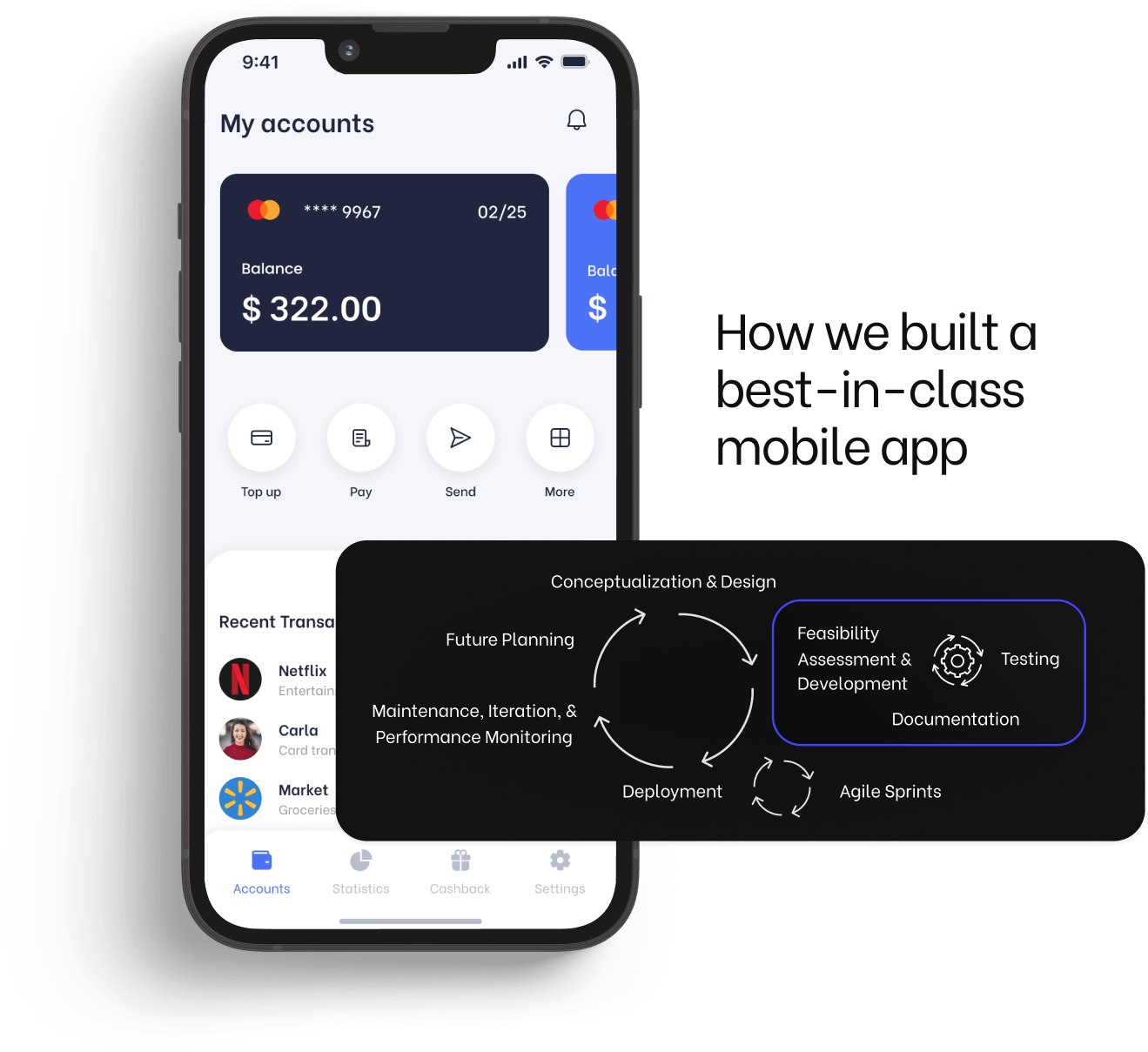

Our client’s vision was to provide an all-in-one financial experience, offering debit cards, bank accounts, credit services, and a budgeting app in one easy-to-use mobile platform.

Our team worked to build the app from scratch using React Native.

We integrated complex and diverse banking features into the app, while ensuring ease of use, high performance, and robust security.

Our work in action

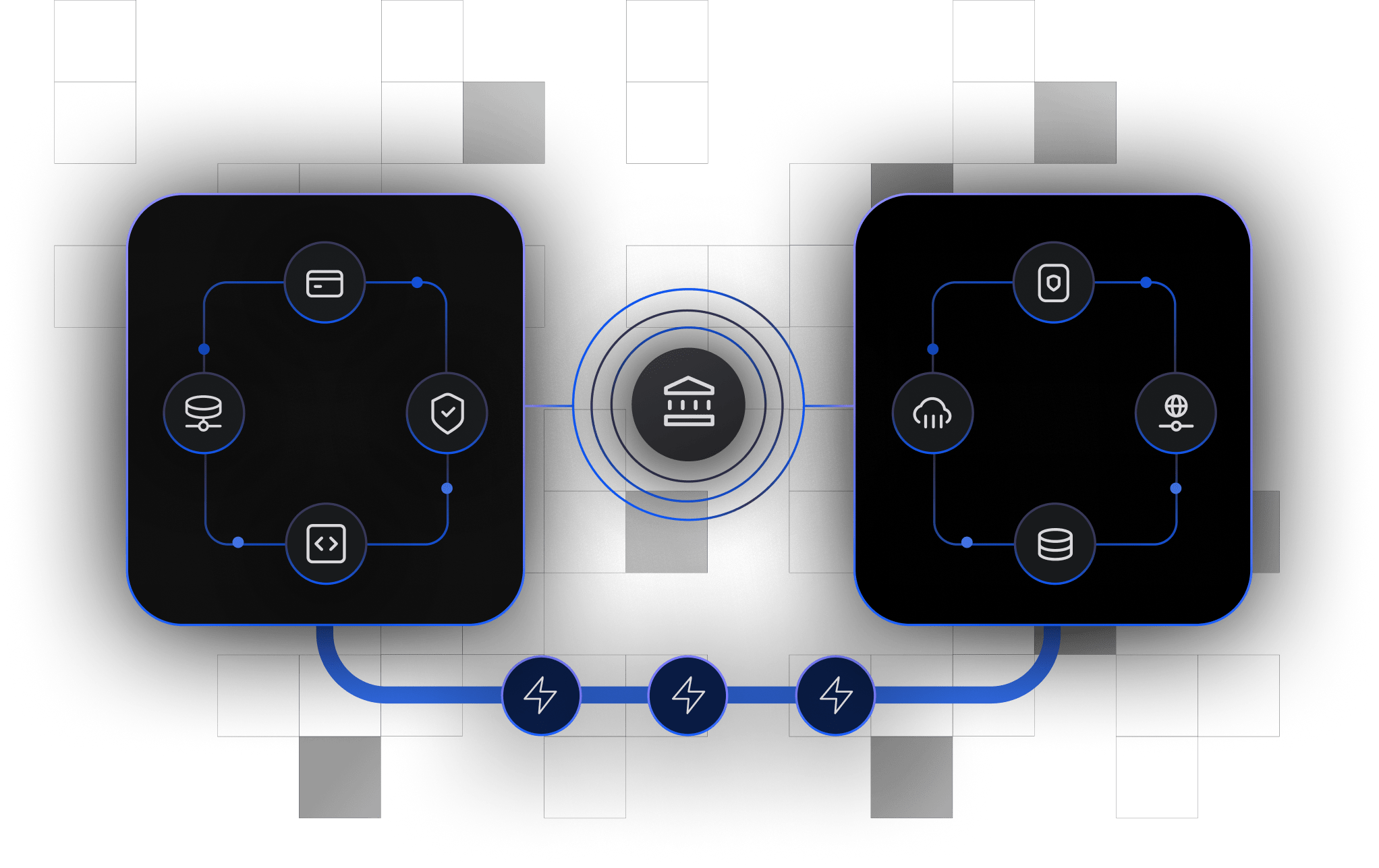

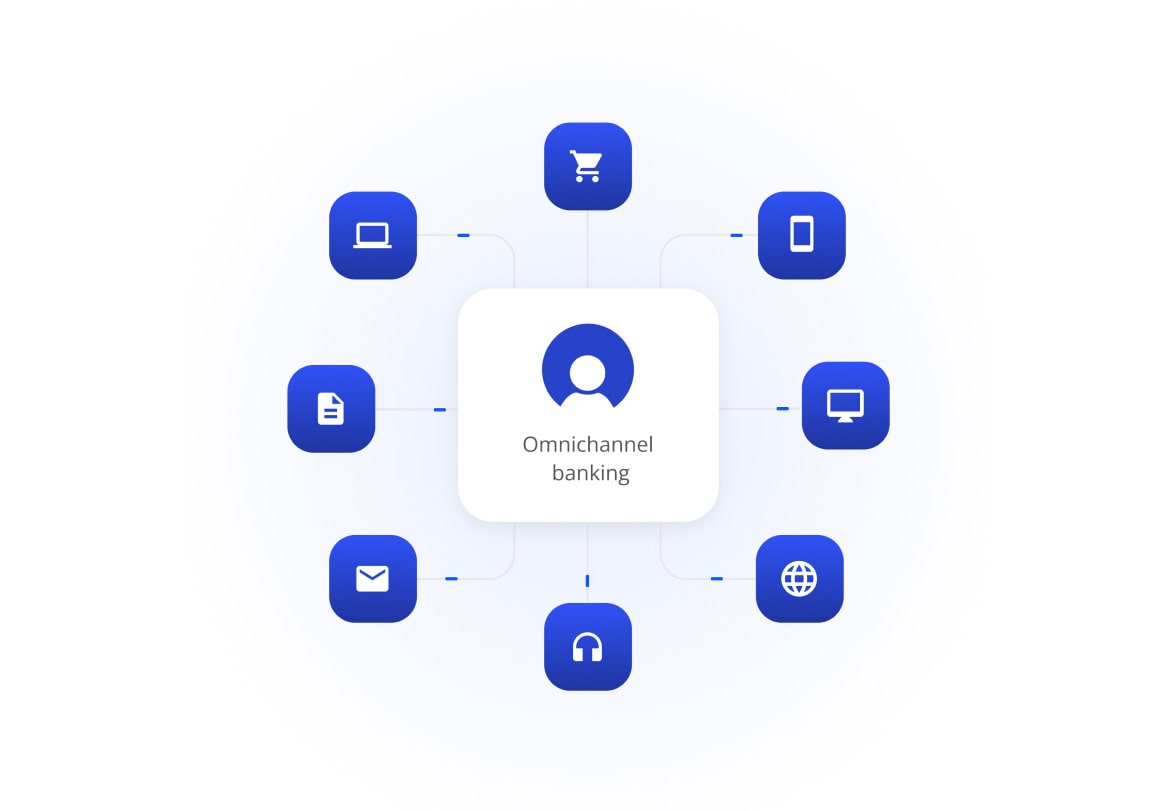

Our client that boasts 28 million+ customers, and is one of America's most renowned financial institutions, is redefining modern banking.

They’re providing all the modern financial services people expect today, such as being able to transfer money, pay bills and more, online or on your phone— without a physical bank.

To achieve this, Qubika brought together a set of digital banking technology services, including

Data and AI-Driven Financial Services

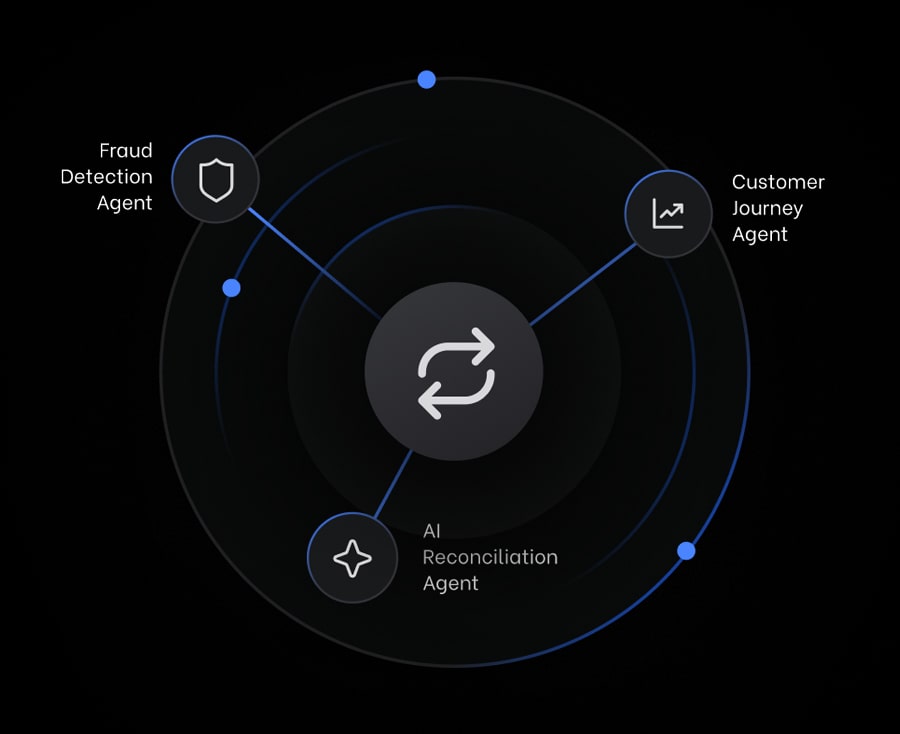

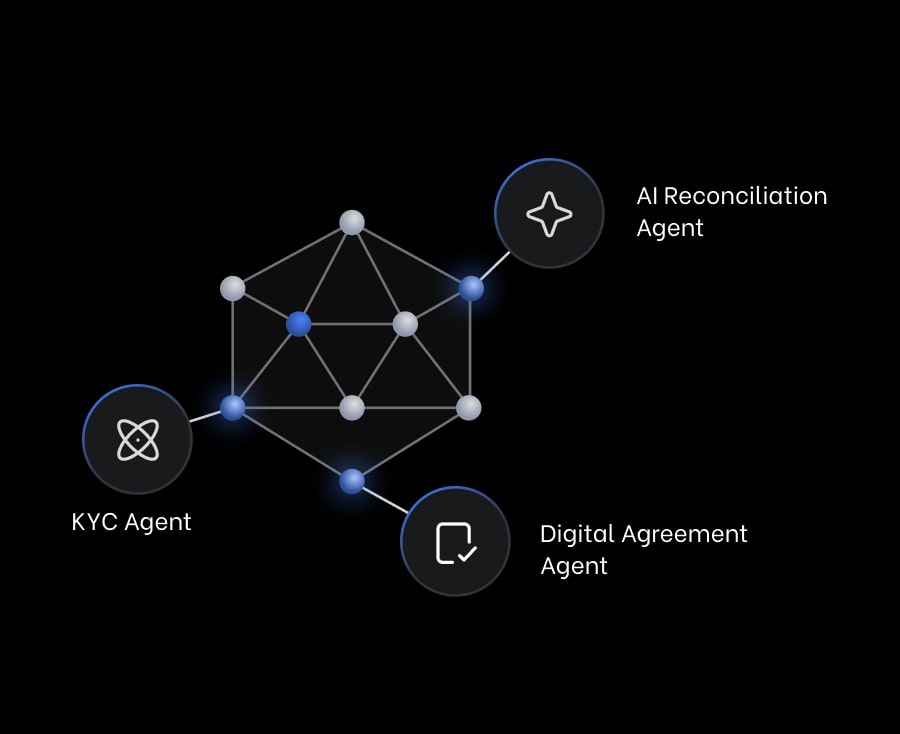

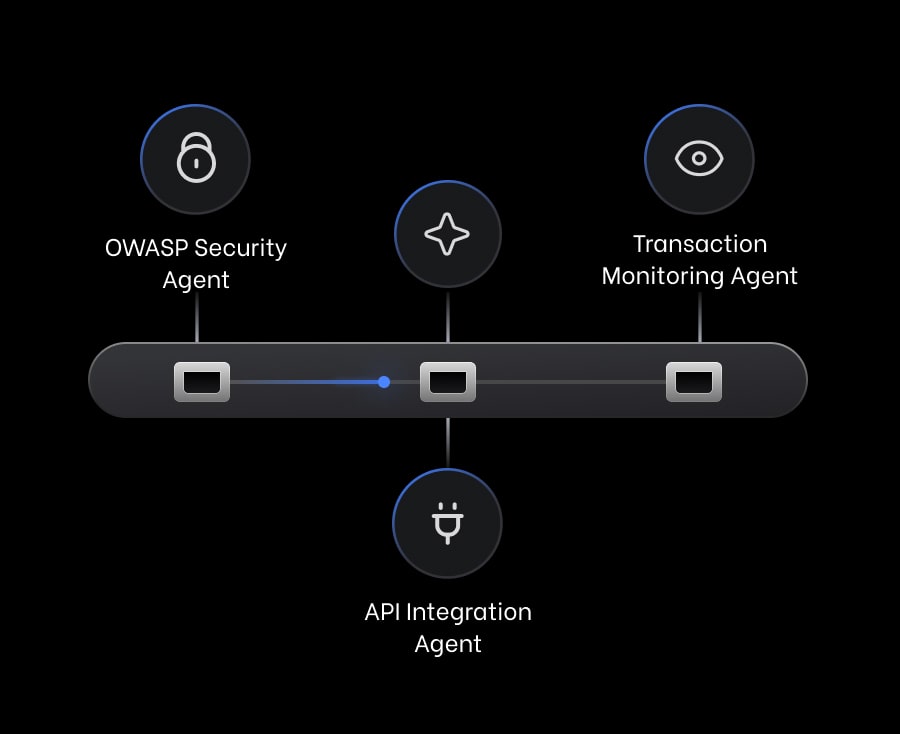

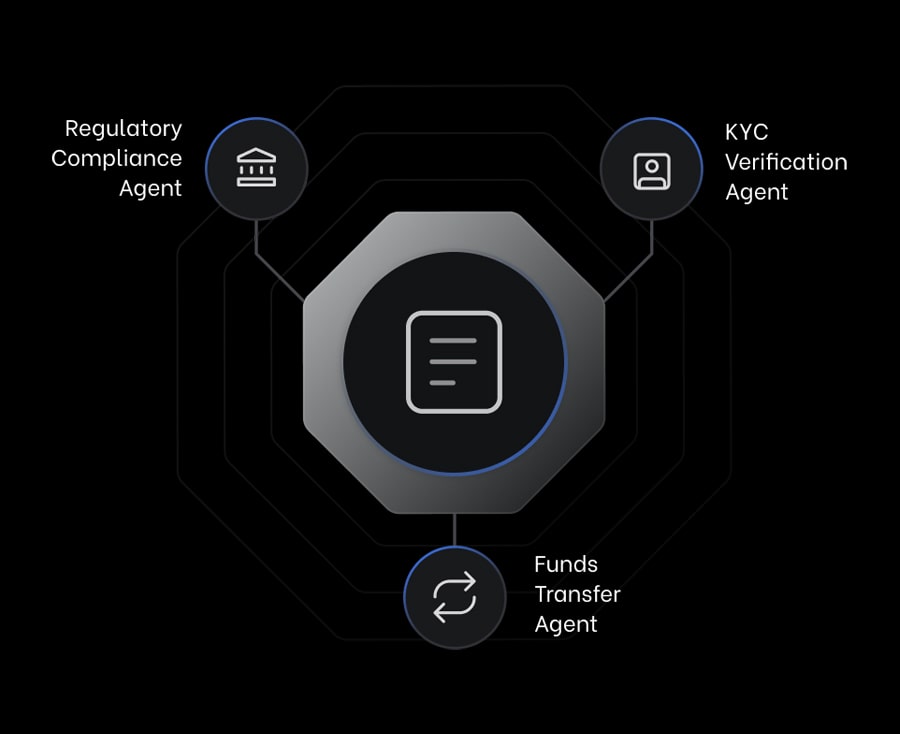

Sample Agents Built & Deployed by Qubika

We design intelligent agents that automate critical payment workflows, reduce manual effort, and improve accuracy across the entire transaction lifecycle.

We build AI agents that streamline lending operations, enhance decision accuracy, and create faster, more reliable borrower experiences.

Our agents strengthen the backbone of financial platforms - enhancing security, simplifying integrations, and monitoring transactions.

Combining deep banktech expertise with advanced AI, we design agents that enhance compliance monitoring, automate KYC workflows, and ensure reliable execution of funds transfers.

Agentic AI Webinar

The Data Foundations

Design, build, and maintain robust data pipelines optimized for high-volume financial data ingestion, transformation, and reconciliation—supporting real-time processing, regulatory reporting, and risk analytics.

Architect scalable, secure data platforms (e.g., on Databricks or other cloud-native ecosystems) capable of handling complex financial datasets, including transactional records, market data, customer interactions, and fraud analytics workloads.

Implement advanced data security frameworks, encryption strategies, access controls, and continuous audits aligned with financial regulations such as PCI-DSS, GDPR, GLBA, SOX, and region-specific banking compliance requirements.

Establish rigorous governance processes to ensure accuracy, completeness, lineage, and consistency across financial datasets - supporting audit readiness, risk management, and regulatory reporting standards.

Seamless transition of legacy data systems to modern, cloud-based platforms. Enable seamless migration from legacy financial systems (core banking, underwriting, payments, trading platforms, etc.) to modern, cloud-based architectures - ensuring data integrity, lineage tracking, and zero-downtime cutovers where required.

Develop advanced dashboards, reporting systems, and embedded analytics tailored for financial operations - including portfolio insights, risk and fraud monitoring, customer analytics, and operational KPIs.

Our Key Partner Certifications

Learn more about Qubika Finance Solutions

We help clients conceive, build, and launch full-featured digital banking products and platforms. This ranges from user onboarding, wallets, payments, ledger and account management, to customer-facing banking experiences.

We develop AI-driven credit scoring models that leverage a broader set of data (customer behavior, transactions, external credit bureau data, etc.) to generate more accurate, dynamic assessments of creditworthiness.

Using machine-learning and data science, we build predictive models that assess borrower risk: estimating default probability, bankruptcy risk, or debt-collection likelihood based on payment histories, transaction data, credit bureau information and behavioral signals.

Our AI Financial Analyst solution is based on a compound AI system that processes structured and unstructured data and allows a company to very quickly answer complex questions about its data.

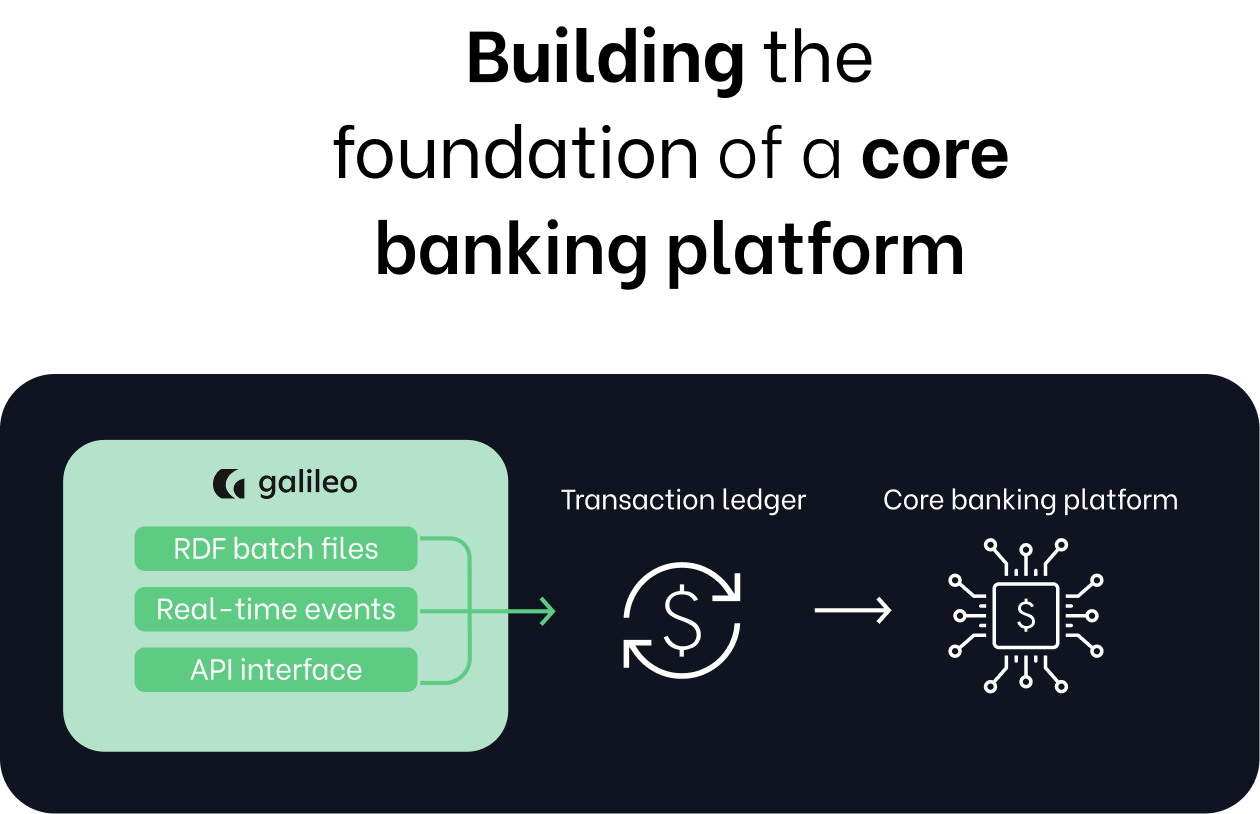

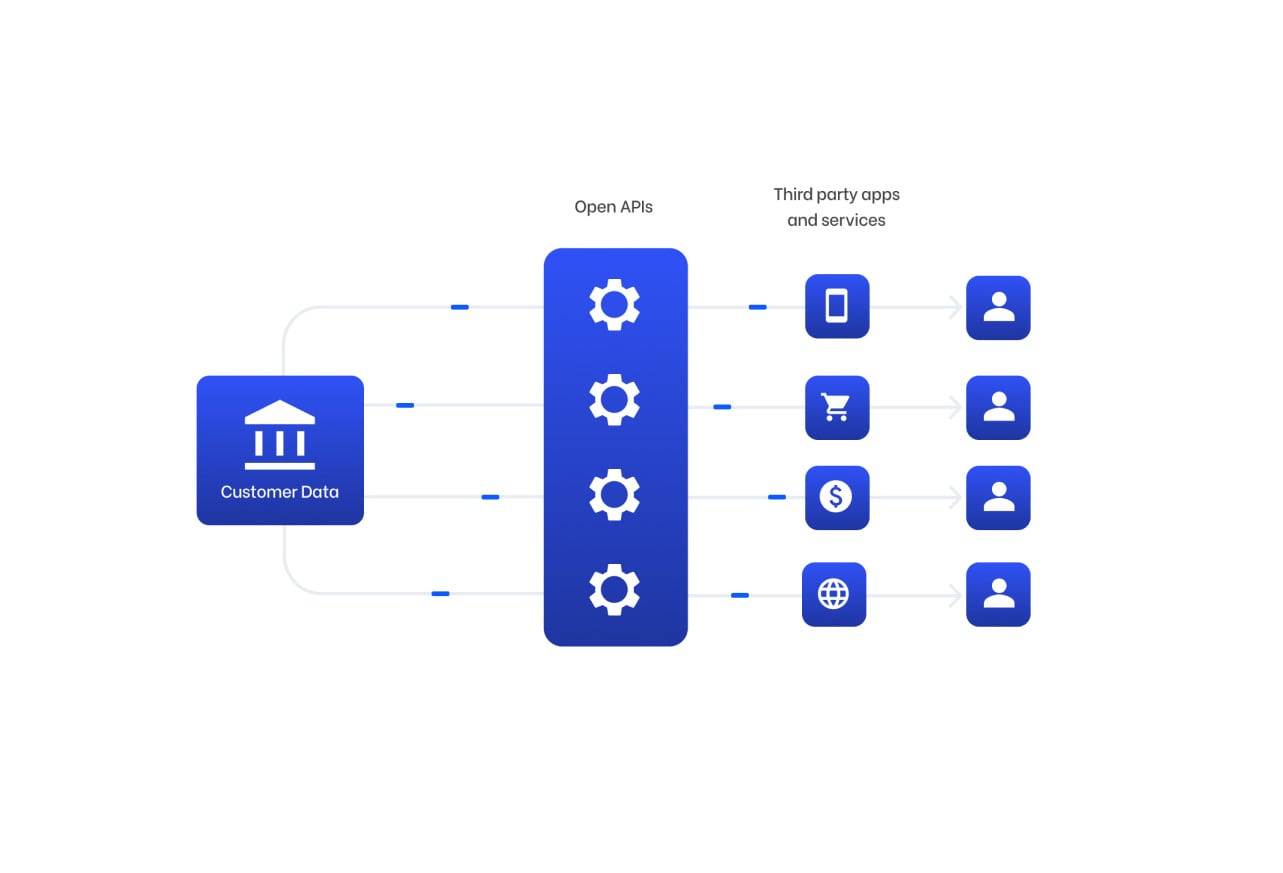

We have deep expertise integrating with modern banking-as-a-service (BaaS) ecosystems such as Galileo, APIs, and third-party core banking or payments platforms. This allows clients to plug in financial services without reinventing core banking infrastructure.

Leveraging algorithms (both off-the-shelf as well as custom) including XG-Boost based AI risk models, Qubika builds intelligent fraud-detection systems tailored for financial services. This specific solution focuses on the probability of 3rd party fraud, using the first 6 months on book as the time window.

Accelerators

They ensure high quality results, based on tried-and-tested technologies, ensuring alignment with industry best practices and regulations.

Streamline your banking app development with our intuitive UI wrappers.

Rapidly prototype and then customize user interfaces, empowering you to craft distinctive, engaging financial experiences that resonate with your customers.

Businesses can jumpstart their machine learning workflows with Qubika's Airflow Blueprints.

Our pre-built templates and reusable components streamline pipeline creation and optimize resource utilization within the Airflow environment.

Gain real-time insights into the health of your machine learning models with our pre-configured dashboards. Visualize key performance metrics like accuracy, precision, and drift over time.

Set automated alerts to proactively address any performance degradation, ensuring your models remain effective and reliable.

Streamline AI/ML infrastructure deployment and management using industry-leading platforms like Databricks, Snowflake, Airflow, dbt, and MLflow.

We deliver excellence

Cybersecurity

BI and Data Engineering

BaaS Integrations/API Integrations

Cloud Migration & Optimization

App Modernization

QA

Protect your sensitive data and maintain customer trust with our robust cybersecurity solutions. We help you identify vulnerabilities, implement best practices, and ensure compliance with industry regulations.

Harness the power of your data with our BI and data engineering expertise. We help you collect, store, analyze, and visualize data to gain valuable insights and make informed business decisions.

Seamlessly connect your systems and leverage third-party services with our BaaS and API integration expertise. We ensure smooth data flow and enable you to build a truly integrated financial ecosystem.

Accelerate your journey to the cloud with our migration and optimization services. We help you modernize your infrastructure, reduce costs, and achieve greater scalability and flexibility.

Transform your legacy applications into modern, cloud-native solutions. We help you enhance performance, improve user experience, and reduce maintenance costs.

We provide specialized QA services for financial institutions, ensuring that AI-driven systems, digital banking products, payment platforms, data pipelines, meet the highest standards of reliability, security, and regulatory compliance.

“For us they are not just a software provider, they are a trustworthy partner with high level technical knowledge that provides value through innovative technical solutions”

Javier Martinez

CTO, Bancard

“They are behind the most important channel for BCP – the one that’s responsible for 90% of transactions.

This gives a sense of the importance of the relationship and our trust in them.

The expertise and skills of their team has been instrumental in helping us make the shift to become a truly digital bank.”

Christian Cervero

Head of alternative channels and digital solutions, BCP

“They’re the highest-quality development firm I’ve ever worked with. I can firmly say that they have provided excellent service.”

Abe Matamoros

Co-Founder, Elliegrid

“They have the culture, the people, the personalities and the interest in aligning towards a common goal with our larger business. They became an extension of our business and their team never felt like a vendor”

Michael Fay

VP Media Distribution, Disney Streaming Services

Success Stories

Avant, a Chicago-based frontrunner in the financial technology sector, has always recognized the potential of harnessing data-driven intelligence - they currently connect 3 million customers to $9 billion in loans and 1 million credit cards. Qubika is leading Avant’s data and machine learning efforts.

Our work includes implementing new data pipelines, and using AI to drive innovation in key business areas, such as rapidly assessing a person’s credit worthiness.

Success Stories

OnePay, majority-owned by Walmart, is simplifying banking with its all-in-one financial experience.

The collaboration with Qubika has enabled OnePay to harness data-driven insights, driving its growth and delivering a superior banking experience to customers. It has become one of the standout leaders in the fintech industry.

Success Stories

With clients in over 100 countries, and over 21,000 employees, Experian is at the forefront of global information and financial services.

Experian is relying on Qubika’s data and financial expertise to build new financial services products at scale. This work involves massive scale integrations including banking-as-a-service integrations. We play a crucial role in ensuring the accuracy, security, and efficiency of transactions.

White Paper

Finance Insights

This white paper introduces Qubika’s modular, production-ready architecture for building agentic AI systems using Databricks and LangGraph - designed for scalability, observability, and business impact.

Learn more

White Paper

Finance Insights

The fintech revolution demands exceptional user experiences. Discover how to overcome the unique challenges of UX/UI design in our white paper, based on Qubika’s work at New York University.

Learn more

If you’re interested in expanding your understanding of the Fintech industry, consider attending some of the most anticipated events in 2026

In this post, I share how to build production-grade systems in finance. By combining Databricks, LangGraph, Milvus, and Neo4j, enterprises can build agentic AI architectures that unify data silos, ensure compliance, and deliver trustworthy insights at scale.

Senior leaders in banking and fintech met in Salt Lake City to discuss how AI is reshaping products, risk, and regulation. Sessions highlighted practical deployments across fraud, underwriting, support automation, and secure LLM usage—alongside the non-negotiables of governance and cybersecurity. The event featured a Qubika case study on AI workflows for global payments, showing faster resolutions and sharper compliance with strong guardrails and human oversight.

FAQs about Qubika's financial services capabilities

Get in touch with our experts to review your idea or product, and discuss options for the best approach

Get in touchArtificial Intelligence Services

Accelerate AI

Healthcare Solutions

Data

Agentic Factory

Financial Services Technology

Platform engineering

Data Foundation

AI Blog Post